Why Sega’s Early Bet on Nvidia Could Have Created Industry Giants

In 1996, Sega made an unexpected investment decision that quietly marked a pivotal point in technology history. Sega’s $5 million investment in Nvidia, restructured from a failed contract agreement meant for graphic chip development for the Sega Dreamcast, turned into a notable financial journey. As admirable as this investment was initially, the full potential unveiled by its growth remained unrealized by Sega.

The Early Investment in Nvidia

The origins of this story lie in Sega’s ambition to develop the most advanced gaming console of its time, the Sega Dreamcast. During this era, Nvidia was an emerging technology firm striving to establish itself in the bustling world of computer graphics. Sega’s decision to convert its final payment to Nvidia into equity was a move not often seen in industry transactions, hinting at a speculative trust in Nvidia’s potential.

This collaboration between Sega and Nvidia could be seen as a gamble on innovative technology, potentially positioning Sega at the forefront of digital evolution. By redirecting the development costs into Nvidia’s burgeoning business, Sega set the stage for a mutually transformative journey.

Unloading Shares and Missed Fortune

Sega’s decision to sell its shares in Nvidia shortly after the company went public is where speculations about missed opportunities come into play. Originally, Sega’s stock sale earned it a return of $15 million, tripling their original investment. This exit, while profitable from a short-term perspective, ultimately forfeited a much more lucrative opportunity.

It’s reported that if Sega had maintained its stakes, they could have witnessed their initial investment skyrocket to approximately $1 trillion today. The foresight to hold onto those shares is a testament to the unprecedented growth Nvidia would experience as a leader in graphics processing technology.

The Rise of Nvidia: From Genesis to Colossus

Nvidia’s trajectory since its inception represents a formidable journey of technological advancements and market triumphs. The company continued to revolutionize the industry by pioneering GPU technology and expanding into fields that went far beyond gaming. Their contributions to AI, data centers, and autonomous vehicles underscore their colossal valuation and global influence today.

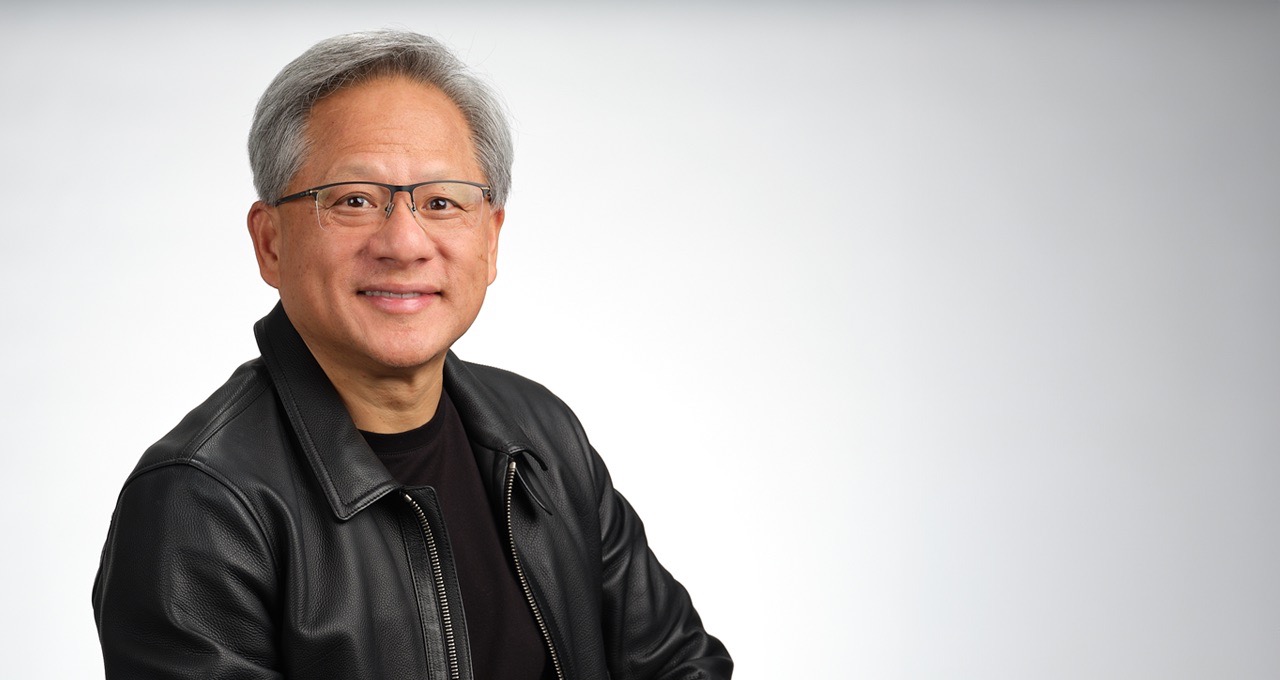

Nvidia’s CEO, Jensen Huang, plays a significant role in this success story. His visionary leadership has been instrumental in navigating Nvidia through decades of dynamic technological landscapes, culminating in the exponential growth attributed in part to pivotal investments like Sega’s.

The What-If Game: A Retrospective on Missed Opportunities

The ‘what if’ scenarios surrounding Sega’s decision offer interesting lessons. While fiscal foresight is key, market dynamics and corporate strategies often cloud judgment, which is apparent in Sega’s case. Understanding market volatility and visionary patience could have placed Sega in an unimaginable league if the market holding had been idealized.

This case study invites the tech and gaming industries to reflect on strategic investment decisions. Beyond profit margins, there’s an essential narrative about gauging potential and resilience over immediate financial gains. Sega’s historical choice serves as a reminder of the unforeseen magnitude technological investments can reach.

In conclusion, while Sega’s initial engagement with Nvidia was innovative and profitable, its failure to realize the future potential cost them an industry-altering fortune. An oversight, for sure, but a story that continues to inspire and teach about the unpredictable nature of the technology market.