Auto insurance for electric cars: some particularities to know

Electric car insurance has certain particularities compared to traditional vehicles. Understanding these aspects is essential for electric car drivers to choose appropriate coverage. It is also essential to be aware of the different guarantee options available in order to benefit from maximum advantages offered by insurers.

What are the specific aspects of electric car insurance?

L’electric vehicle insurance presents specific challenges compared to traditional vehicles. With the rise of electric mobility, insurance companies have had to adapt their policies to meet the needs of these new electric car owners.

Battery coverage

Electric car batteries often represent a significant portion of the total vehicle cost. Additionally, they can be costly to replace in the event of damage resulting from an accident, theft or malfunction. However, some insurance policies offer specific coverage for these so-called batteries. This type of insurance therefore helps protect the owner’s investment during these unforeseen events.

Insurance premium

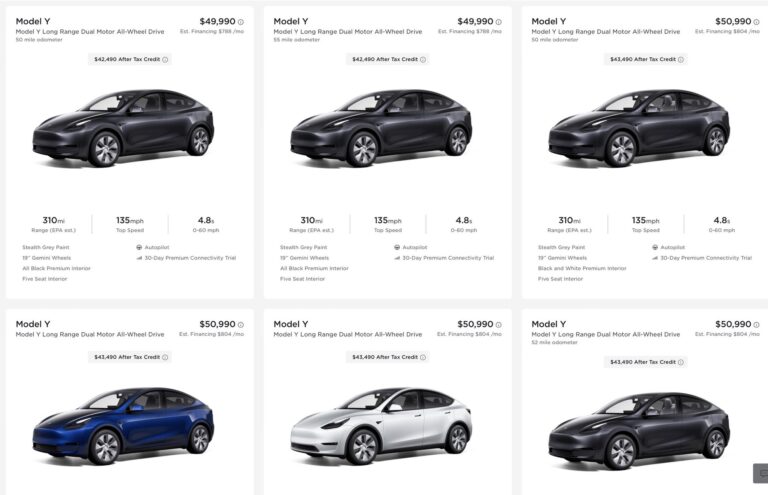

In the case of electric cars, these premiums can be influenced by several factors: the value of the vehicle, the battery technology and the risks associated with electric propulsion. For example, their higher price can lead to higher insurance premiums. On the contrary, the advanced safety features of certain models can lead to the reduction of the cost of insurance.

Technology-specific coverage

Some insurers offer specific coverage for technologies specific to electric cars. This includes charging systems and semi-autonomous driving devices. This coverage can help protect against damage or breakdowns related to these technologies.

Specialized roadside assistance and repairs

Due to the complexity of the systems and batteries, electric cars may require roadside assistance and specialist repairs if they break down. Some insurers offer roadside assistance services specifically tailored to this type of model. There are also networks of approved repairers trained to work on electric vehicles.

What guarantees do electrical insurance companies offer?

Electric cars are becoming more and more popular due to their reduced environmental impact and energy efficiency. To encourage their adoption, many insurance companies offer guarantees specifically designed for electric cars. These initiatives aim to make insurance more attractive while promoting environmental sustainability.

Premium reductions

Some insurance companies offer premium reductions for electric cars due to their low environmental impact and increased safety. These reductions can be granted based on criteria such as driver safety, vehicle safety and the frequency of use of renewable energy sources.

Charging options

Some insurers offer reimbursement options for using charging at home rather than at charging stations at motorway rest areas. This type of option aims to encourage the use of renewable energy sources by rewarding drivers for their use of green electricity.

Emerging trends

New things like usage-based insurance are gaining popularity right now. This type of insurance uses driving data to adjust premiums based on driver behavior and electric vehicle use. Drivers can thus benefit from bonuses based on their actual driving behavior.

In conclusion, electric car insurance has specific features to consider when choosing insurance coverage. Understanding these aspects is essential in order to benefit from adequate protection. By monitoring emerging trends, electric car owners can find insurance options tailored to their needs and get optimal coverage for their vehicle.